Products & Services

We are committed to providing you with products designed to surpass the high expectations of today’s consumer, the opportunities of the fast-changing digital world and the evolving regulatory framework.

Our goal is to ensure that everything we do is Simple, Personal and Fair, keeping Consumer Duty principles at the heart of our business and across our entire product range. The automotive sector is constantly evolving, which is a good reason to partner with a finance company with innovation and speed to market at its core.

Retail finance

A comprehensive range of finance products to meet the varied and changing needs of both personal and business customers. We are here to help you sell more vehicles, more often, and more profitably.

Specialist financing

We provide finance for a variety of ‘non-standard’ vehicles, including high value premium marques, specialist executive cars and wheeled business assets (including transporters and construction plants). Please contact us for further information.

Customers for life

Customers for life offers a series of online training modules, virtual webinars and workshops, as well as Gateway, our free-of-charge lead delivery tool.

Wholesale funding support

Our range of wholesale solutions is designed to enhance your cash flow. Our financial stability offers a partnership with a dependable provider regardless of the market or other influences.

A bespoke service provided by specialist credit and support teams who are flexible and responsive to changes in your requirements.

3rd Party integration

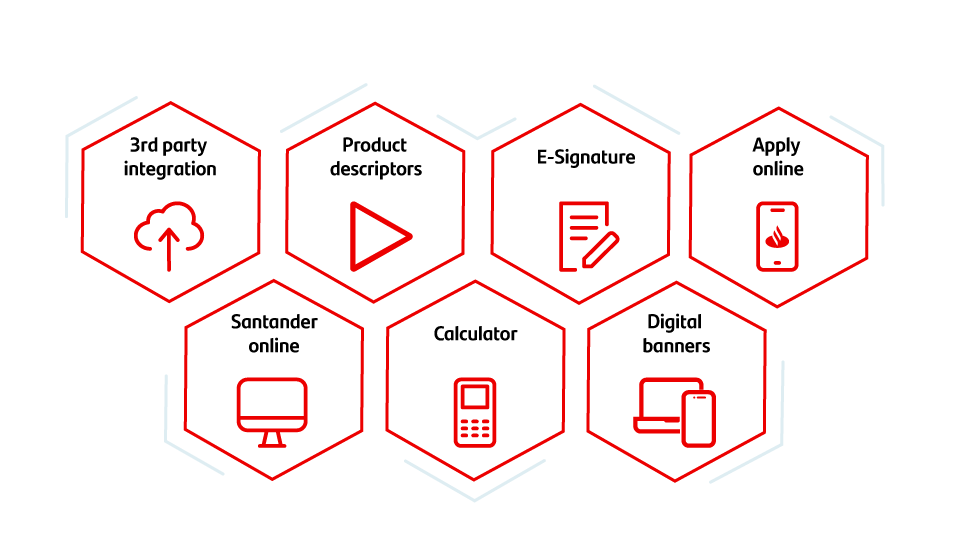

Our range of digital tools integrate together to create a seamless customer journey. Connecting to our digital products couldn’t be simpler; our tools have been created to seamlessly integrate with your Point of Sale finance system.

Our digital capabilities

With customer behaviour continually changing and the digital market evolving, we are constantly investing and innovating, helping to provide you with complimentary tools to engage better with customers and help you sell more cars.

Sales team service

We pride ourselves in the strong and enduring relationships we’ve created with many dealer partners across the UK. The breadth and diversity of these relationships provides an in-depth understanding of the challenges you face.